In the U.S., homeownership is often thought of as the ideal method for building financial stability. Not everyone owns a home, though. Take a look at the statistics for 2024 on homeowner data in the U.S.

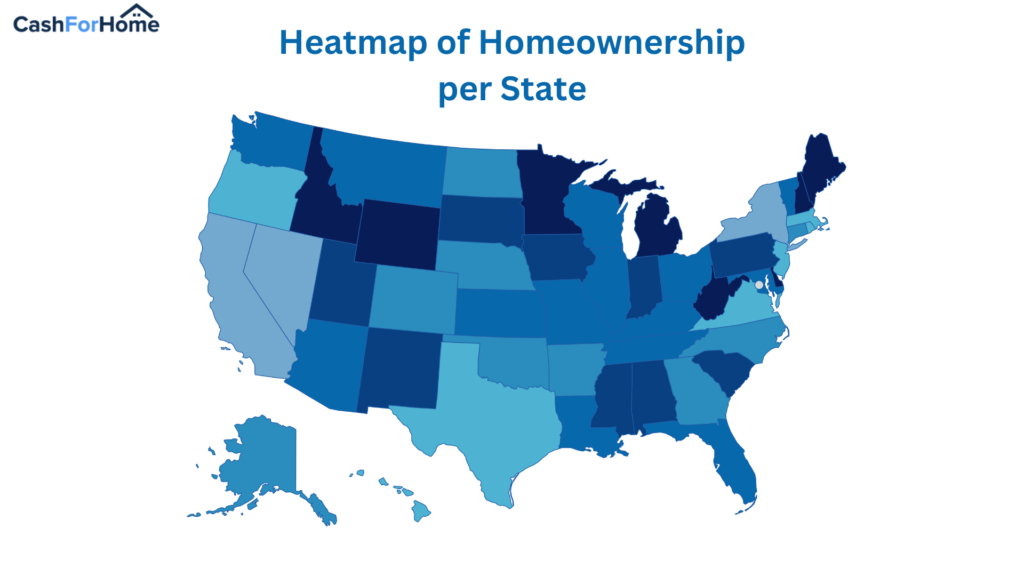

The following statistics show the percentage of people within each state that own their homes. This information is from the U.S. Census Bureau.

| Alabama | 70.20% |

| Alaska | 66.10% |

| Arizona | 67.40% |

| Arkansas | 66.50% |

| California | 55.80% |

| Colorado | 66.40% |

| Connecticut | 66.30% |

| Delaware | 74.10% |

| Florida | 67.20% |

| Georgia | 65.90% |

| Hawaii | 62.60% |

| Idaho | 72.30% |

| Illinois | 67.10% |

| Indiana | 70.80% |

| Iowa | 72% |

| Kansas | 67.70% |

| Kentucky | 68.80% |

| Louisiana | 67.60% |

| Maine | 74.10% |

| Maryland | 67.70% |

| Massachusetts | 62.20% |

| Michigan | 73.20% |

| Minnesota | 72.10% |

| Mississippi | 69.90% |

| Missouri | 67.60% |

| Montana | 68.80% |

| Nebraska | 66% |

| Nevada | 60.30% |

| New Hampshire | 72.30% |

| New Jersey | 64.60% |

| New Mexico | 70.90% |

| New York | 54.10% |

| North Carolina | 66.70% |

| North Dakota | 65.10% |

| Ohio | 67.30% |

| Oklahoma | 65.40% |

| Oregon | 62.80% |

| Pennsylvania | 69.10% |

| Rhode Island | 63.30% |

| South Carolina | 72% |

| South Dakota | 69.60% |

| Tennessee | 67.20% |

| Texas | 62.50% |

| Utah | 71.20% |

| Vermont | 67.40% |

| Virginia | 64.20% |

| Washington | 67.40% |

| West Virginia | 74.50% |

| Wisconsin | 68.10% |

| Wyoming | 72.70% |

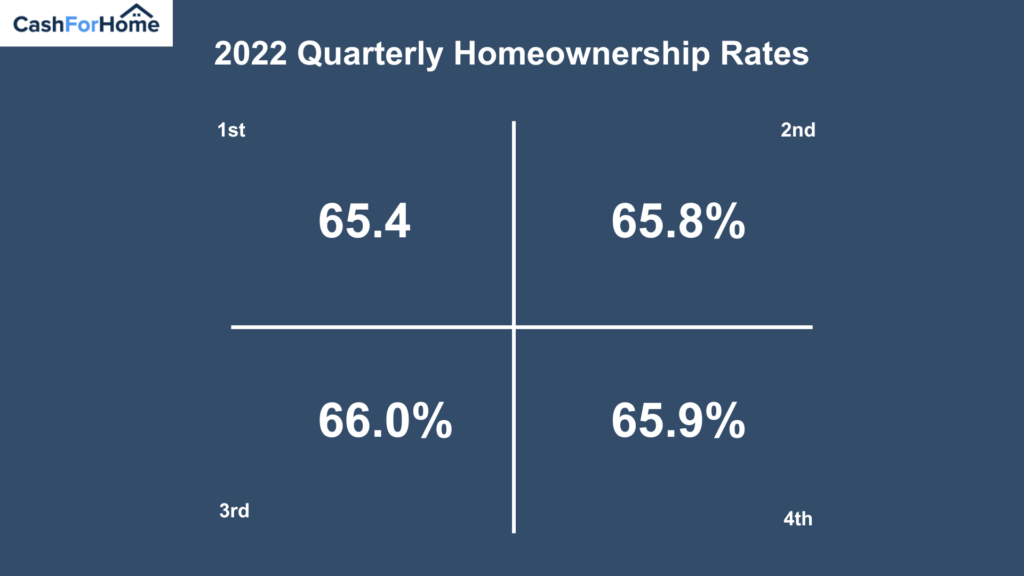

One way to see the difference in homeownership is to look at a quarterly breakdown of this information. As a whole, the most recent data is from 2022, in which the homeownership rate was 66%. That is a combination of all states throughout the U.S.

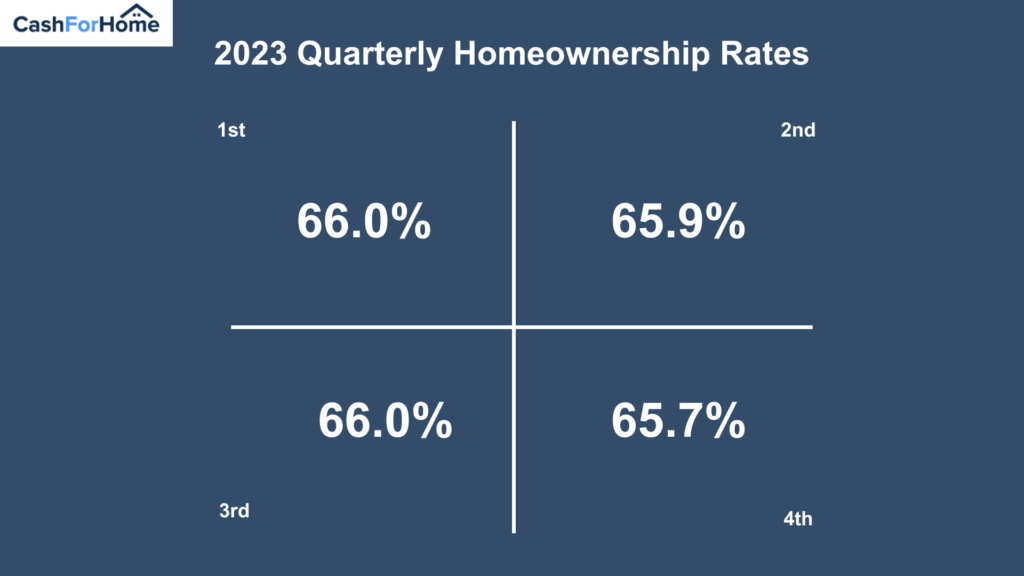

Consider the following differences in the last two years of data from the U.S. Census Bureau:

2022:

2023:

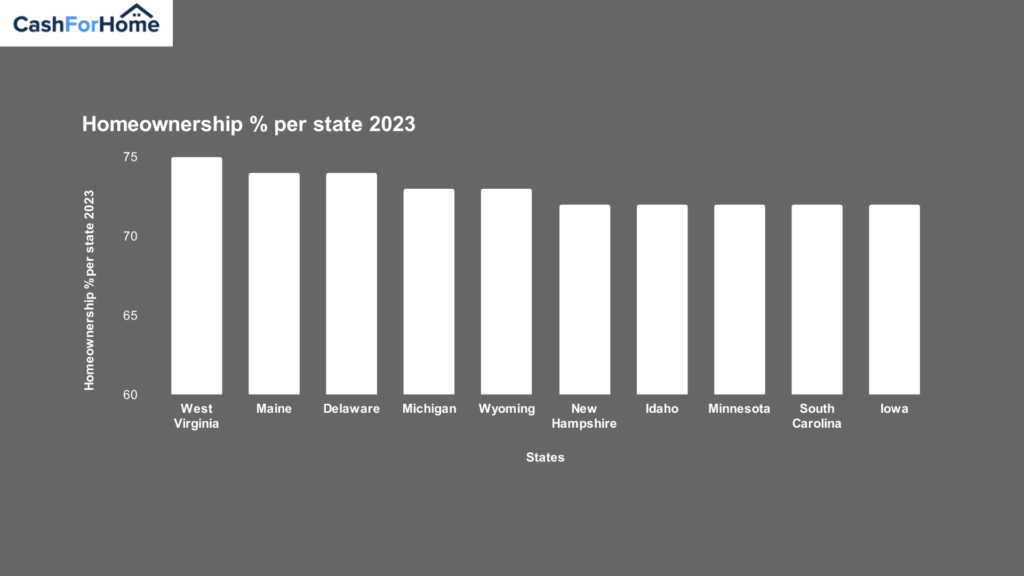

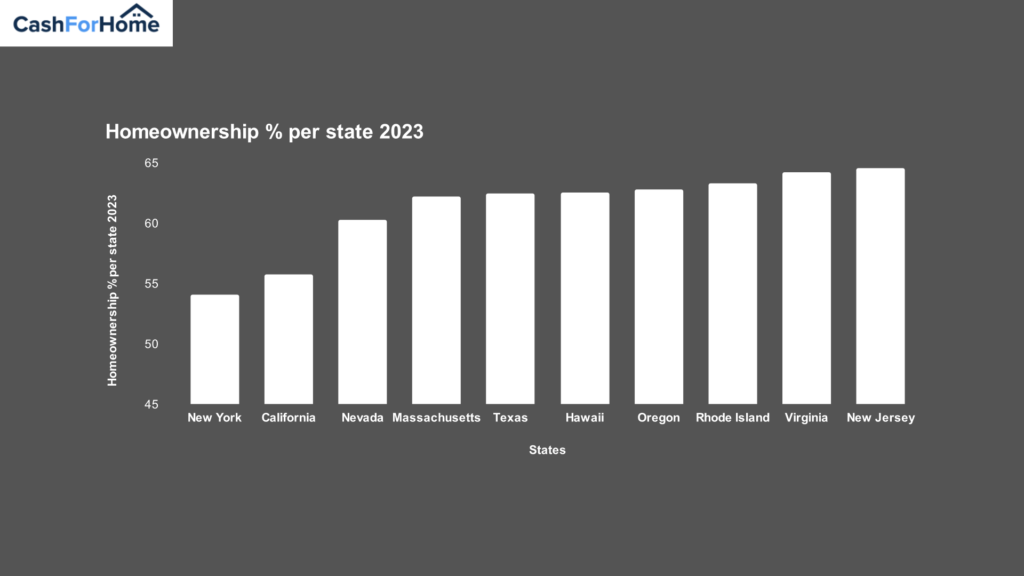

Using the data available from the U.S. Census Bureau, the following are the states with the highest rate of homeownership as of 2023 figures:

Using the data from the U.S. Census Bureau, the following states have the lowest rate of homeownership.

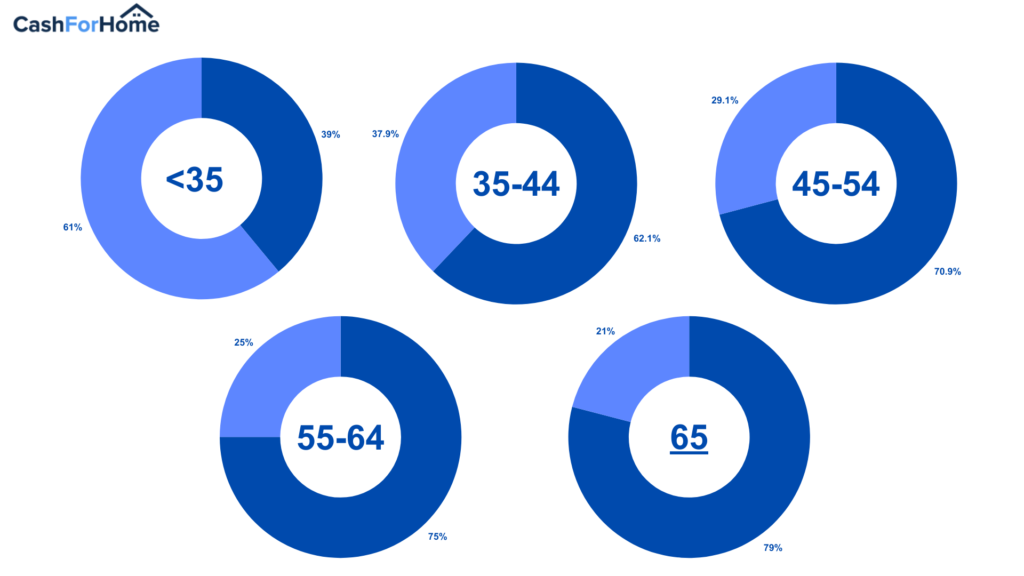

Homeownership can be a goal at any age, but there are some periods of time when it is more likely for a person to purchase a home than at other times. Take into consideration the U.S. Census Bureau data for the most common ages to purchase a home in 2023:

It’s also interesting to note that the average age of a first-time home buyer in the U.S. is 36 years, according to data from the National Association of Realtors. Also notable, second time home buyers (people that have purchased a home prior and are buying again) are older. The average age for a repeat buyer was 59 in 2022.

It can be helpful to look at who is buying homes based on race and ethnicity due to access to funding, income, and other factors. Data from the U.S. Census Bureau shows some interesting insights on these factors from 2023:

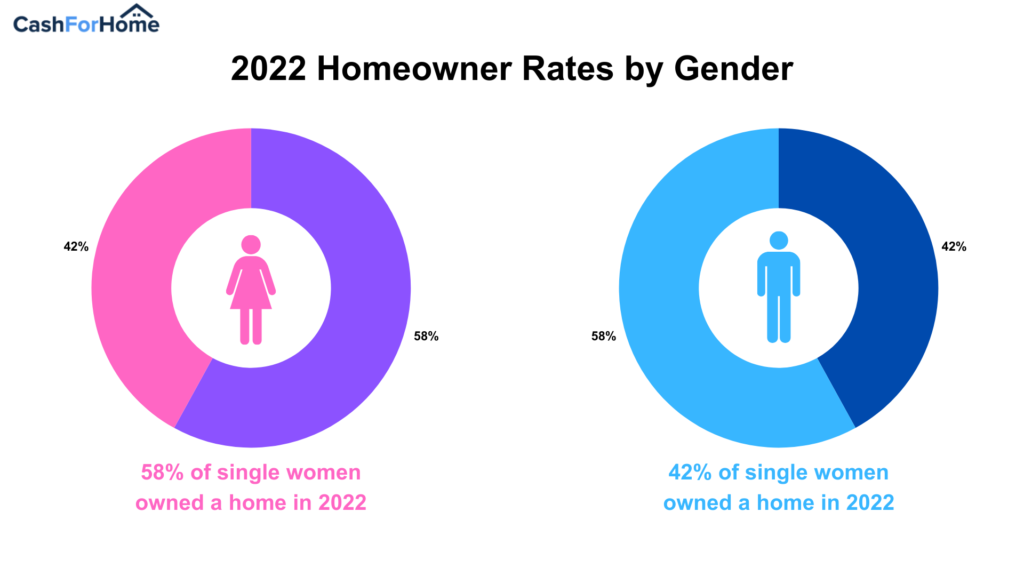

Another factor to consider is homeowner based on gender. Data from Pew Research Center provides the following insights:

In the U.S., 37.9 million homes are owned by one person. That accounts for 29% of all homes in the country, according to data from the National Realtors Association.

These pieces of data paint a clear picture that many people want to own a home and still see it as the ideal way of creating financial stability. Yet, it is not always simplistic for people to purchase homes. There are numerous reasons why homeownership is not as high as it may have been in years past.

The first challenge for many people is getting a loan to purchase a home. That’s not easy to do in any situation, but for some, it’s even harder. That’s especially true if you do not have a high credit score or the ability to build credit.

Some tips for improving access to a loan include:

Obtaining a loan through a federal government-backed program, including FHA or VA loans could help you to further qualify to buy a home. Make sure you take into consideration the options for USDA loans as well, all of which can help first-time home buyers qualify to buy a home.

In some situations, the hardship of buying a home comes from a limited amount of income. Lenders typically want to see that your income is high compared to your monthly expenses, with some lenders looking for a debt-to-income ratio of 30% to 50%. To increase your ability to qualify for a loan, look for ways to extend your income. Here are some ways that may offer help:

Increasing your income can also be done effectively by reducing your debt. If you have a significant amount of debt, that’s limiting how much money you can save. By working to pay down your debt, you actually save money. For example, if you are paying 29% on a credit card and you owe $1,000 on it over the course of the year, that $1,000 debt has grown to $1290. By paying off the $1,000, you end up saving that extra portion of interest costs.

To make homeownership more affordable, you may want to alter where you are considering buying a home. For some, buying a home in the heart of the big city is the goal, while others want to own acres of land. If you’re working on your first-time home purchase, though, consider being more flexible about where you buy. You may be able to buy a home sooner. Consider these tips:

All of these tips can help you to buy a home and maximize your goal of homeownership. By taking a few of these steps, you may be able to reduce how much you’re paying to buy the home of your dreams.

Additional Statistics & Helpful Articles: